Introduction to InterPoL

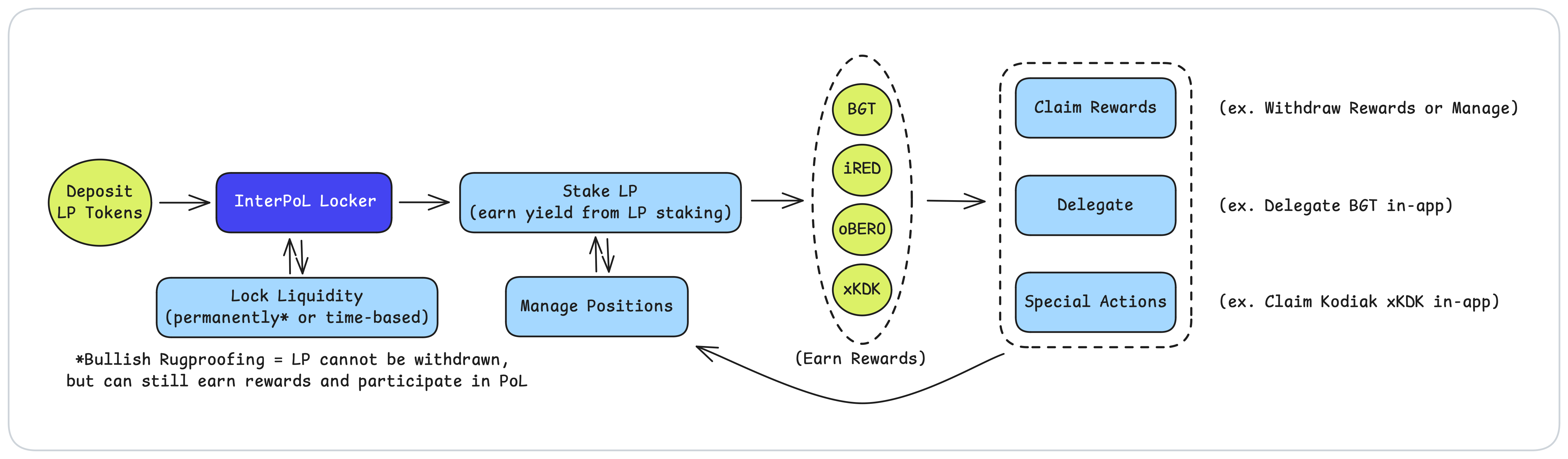

Welcome to InterPoL, a protocol designed for the Berachain ecosystem to provide rug insurance while still enabling participation in Proof of Liquidity (PoL).

What is InterPoL?

InterPoL is a protocol specially designed for the Berachain ecosystem which allows token creators, launchpads, protocols, and more, to deploy protocol-owned liquidity while retaining the ability to stake it and participate in Proof of Liquidity flywheels.

Why Lock Liquidity?

Locking liquidity has become a widespread practice as a way for token creators to prove that token liquidity cannot be withdrawn without notice. Users often look for locked liquidity as a point of reference when researching new token launches or when determining their risk of being rugged, and it is increasingly seen as a minimum threshold for token creators as a sign of goodwill and community protection. Locking liquidity can also be perceived as a method to provide responsible and transparent liquidity pool management.

How is Locked Liquidity Affected by Berachain Proof of Liquidity?

Berachain's unique Proof of Liquidity consensus design directs native chain staking rewards to liquidity providers instead of a [often-centralized] set of validator operators. This makes liquidity core to all activities in the ecosystem, and the ability to utilize liquidity effectively is essential for teams to remain competitive, engage their users, and power novel DeFi applications that lack liquidity on other chains. This presents a dilemma, as using traditional liquidity lock contracts on Berachain forces builders to choose between protecting their users and maximizing their economics.

How Does InterPoL Solve This?

InterPoL (developed by The Honey Jar) provides a novel liquidity locking solution tailored specifically for the Berachain ecosystem allowing builders (token creators, launchpads, protocols, etc.) to lock their liquidity for any duration without having to renounce the yields and incentives offered by whitelisted LP staking protocols. Builders can earn from Proof of Liquidity without being able to withdraw, transfer, swap, or default on their LP. Bullish Rugproofing.