Key Product Features

Enhanced Trust and Security for Token Launches

Users demand responsible and transparent liquidity pool management, especially when it comes to new token launches. While liquidity is locked through InterPoL, users can be assured that there is no risk of a classic rug pull. As the practice of using InterPoL becomes more common, users on Berachain will demand that tokens lock liquidity and token creators who still wantto utilize that liquidity will use InterPoL.

Customizable Locking Periods

InterPoL offers flexible options for indefinite or time-specific liquidity locks, which can be tailored to suit the individual builder's needs.

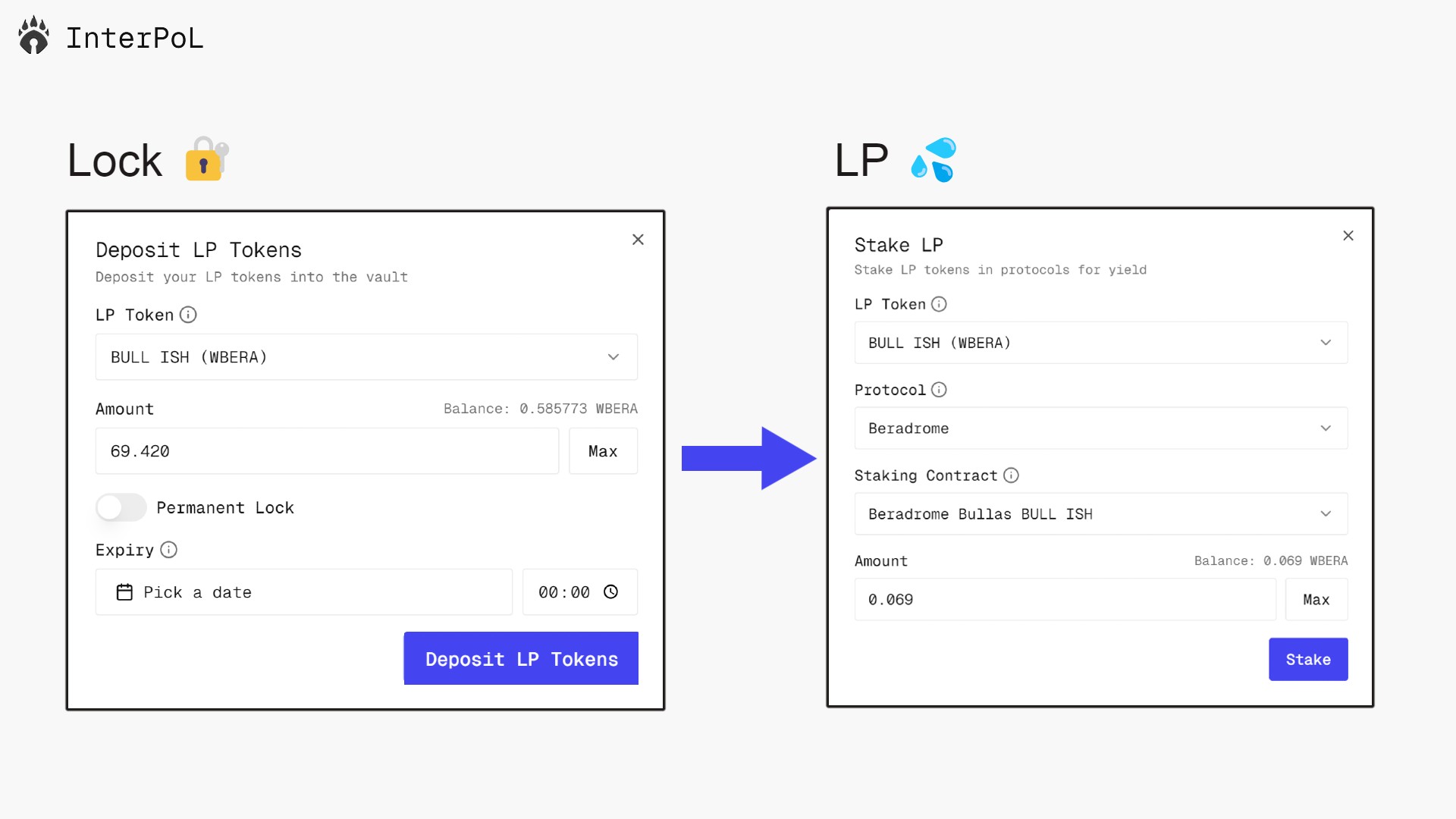

Yield Generation on Locked Liquidity

Unlike conventional liquidity lockers, InterPoL enables locked liquidity to be staked via LP tokens. This allows the various users of InterPoL to earn yield from LP staking protocols, via reward tokens like BGT, iRED, oBERO, xKDK, etc. InterPoL turns a static security measure into an active revenue stream.

API and Integration Support

InterPoL offers an API and native integration into platforms such as token launchpads. Apps that would normally burn or lock liquidity can use InterPoL to retain flexibility. Developers can create InterPoL lockers, lock LP tokens, and then choose whether to retain ownership to stake it themselves or to transfer ownership of the locker to a user or creator on the platform for their benefit.

Referral and Partnership Opportunities

Platforms that integrate InterPoL can participate in our referral program, which further deepens incentive alignment. Platforms provide InterPoL integration for their builders to lock liquidity (which extends peace of mind to their users) and in return they can earn referral fees. This creates an additional revenue model for the token launchpad while promoting safer token launches. If you are interested in participating in the InterPoL Referral Program, please contact us directly.